what is suta tax texas

To find the SUTA. This practice known as state unemployment tax act suta dumping is a common scheme in which a business with a higher unemployment tax rate shuffles employees to another business in order to pay a lower rate.

Suta Tax Your Questions Answered Bench Accounting

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

. What Is Suta Tax Texas. FUTA taxes are assessed on the first 7000 of an employees wages as well. FUTA or Federal Unemployment Tax is a similar tax thats also paid by all employers.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. SUTA stands for State Unemployment Tax Act. It is unlawful for employers to avoid a higher unemployment tax rate by altering their experience rating through transferring business operations to a successor.

Therefore the companys annual FUTA tax will be 006 x 7000 x 10 4200. Employers can learn about unemployment tax file wage reports pay unemployment taxes and establish new unemployment tax accounts on the TWC website. The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund.

The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. States use funds from SUTA tax to pay unemployment benefits to unemployed workers. Chat with us CHAT WITH US.

General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training Investment Assessment. What is SUTA. SUTA dumping compromises experience rating systems by eliminating the incentive for employers to keep employees working and to return unemployment benefit.

SUTA isnt as cut and dry as the FUTA as it varies by state. What is SUTA. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base.

Each state establishes its own tax rate and wage base. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. Learn about the tax liability appeals process.

Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the experience rating system. Newly liable employers begin with a predetermined tax rate set by the Texas UI law. What is SUTA.

2022 Suta Tax Rate Texas. The states SUTA wage base is 7000 per employee. For example the SUTA tax rates in Texas range from 031 631 in 2022.

SUTA State Unemployment Tax Act is a payroll tax paid by all employers at the state level. For Example Texas Will Not Release 2021 Information Until June Due To. The FUTA tax rate is a flat 6 but is reduced to just 06 if its paid on time.

Wages are reported when they are paid rather than when they are earned or accrued. However Virgin island employers must pay 24 to the government since this territory owes the US government money. The state unemployment tax act better known as suta is a form of payroll tax that all states require employers to pay for their employees.

The state unemployment tax act known as suta is a payroll tax employers are required to pay on behalf of. In 2022 the social security tax rate is 62 for employers and employees unchanged from 2021. Liable employers report employee wages and pay the unemployment tax based on state law under the Texas Unemployment Compensation Act TUCA.

Since your business has. For the majority of states SUTA tax is an employer-only tax. However the money collected from the FUTA tax funds the federal governments oversight of each states individual unemployment insurance program.

Lets take the example of Company XYZ which employs ten individuals. Employers report employee gross wages each quarter and pay taxes on the first 9000 per employee per year. Most states send employers a new SUTA tax rate each year.

52 rows SUTA the State Unemployment Tax Act is the state unemployment. SUTA is a tax paid by employers at the state level to fund their states unemployment insurance. What is suta tax texas.

Understand state unemployment tax act suta dumping. This practice known as State Unemployment Tax Act SUTA dumping is a common scheme in which a business with a higher unemployment tax rate shuffles employees to another business in order. These contributions provide monetary support to displaced workers.

Each of these employees earns an annual taxable income of 10000 bringing the total wages to 100000. 9000 Taxable Wage Base X 27 Tax Rate X Number Of Employees Texas Suta Cost For The Year. Some states require that both the employer and employee pay SUTA taxes.

These taxes are put into the state unemployment fund and used by employees that lose their job through no fault of their own causing them to file for unemployment and collect their benefits. An employers SUI rate is the sum of five components. SUTA was established to provide unemployment benefits to displaced workers.

In such a case the tax is applied to the first 7000 in wages paid to each employee. See Experience Rating Method. 2011 Texas Workforce Commission Sitemap Policies Open Records Report fraud.

The fund pays unemployment benefits to employees who have become unemployed at no fault of their own. SUTA was established to provide unemployment benefits to displaced workers. Once an employee makes 7000 in gross wages for the.

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment and Training Investment Assessment ETIA Minimum Tax Rate for 2022 is 031 percent. Generally states have a range of unemployment tax rates for established employers.

Your state will assign you a rate within this range. Maximum Tax Rate for 2022 is 631 percent.

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

Breaking Down The Federal Unemployment Tax Act What Is It

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

2022 Federal Payroll Tax Rates Abacus Payroll

How To Fill Out Form 940 Futa Tax Return Youtube

Florida Payroll Software Payroll Software Payroll Florida

Are Employers Responsible For Paying Unemployment Taxes

What Is Sui State Unemployment Insurance Tax Ask Gusto

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Business State Tax Obligations 6 Types Of State Taxes

What Is Futa Tax 2021 Tax Rates And Information

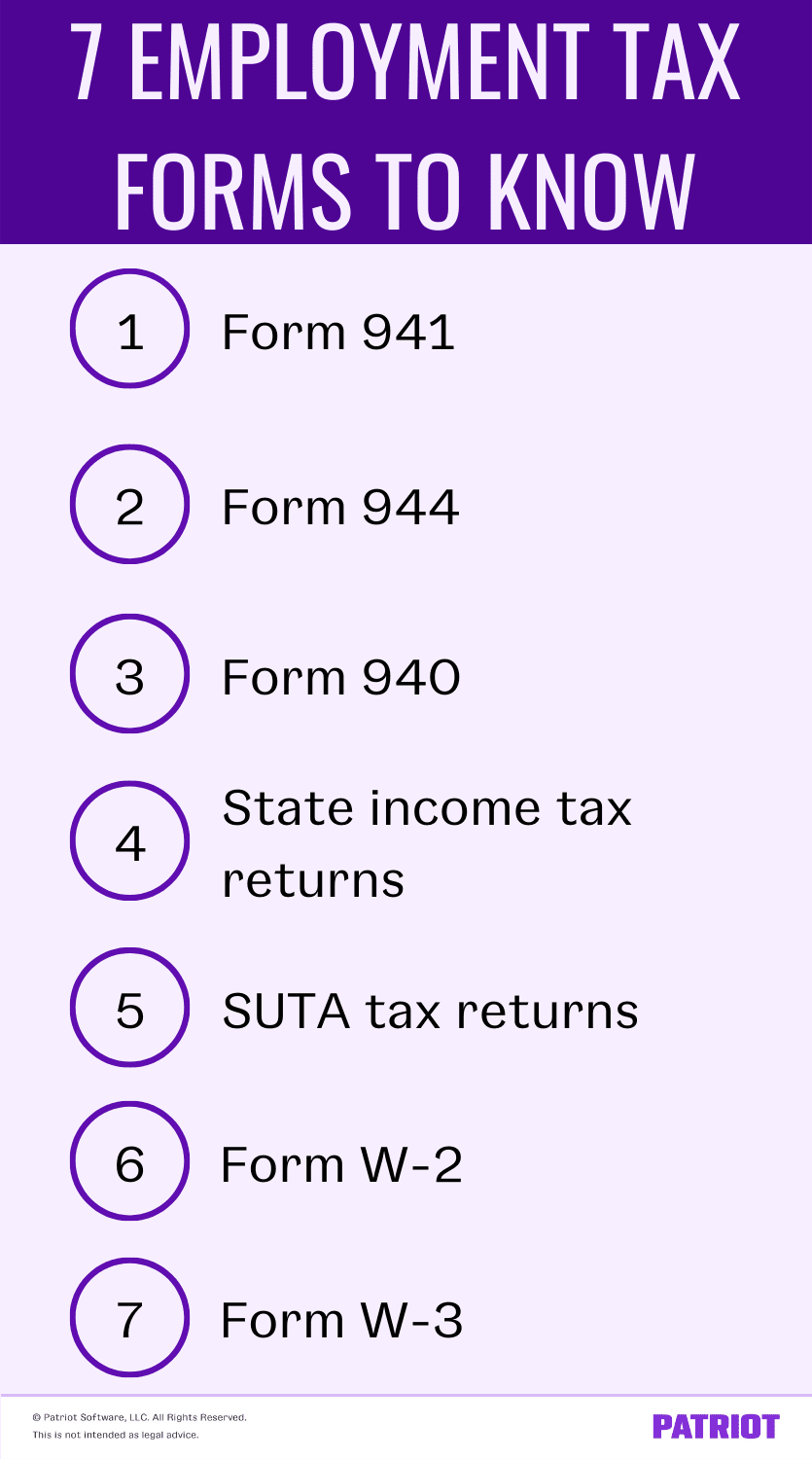

Employment Tax Returns Forms Due Dates More

Sui Sit Employment Taxes Explained Emptech Com

Calculating Futa And Suta Youtube

Futa Tax Overview How It Works How To Calculate

Fast Unemployment Cost Facts For Texas First Nonprofit Companies